EMEA Primary Market Wrap 2023

Download now!

Issuance of Bonds Doubles YoY, Loans Triple Boosted by A&E; Average YTM Jumps to 8%; €76.5B of 2024/25 Bond Maturities Left to Tackle; Wave of Repricings Expected

In this edition of the EMEA Primary Market Wrap, we cover 2023 and use data from Reorg’s bonds and loans database to examine the key trends in the high-yield bond and leveraged loan primary markets.

Some comparisons are drawn to the 2021 market, as a result of a partial closure of the market in 2022.

Key Takeaways

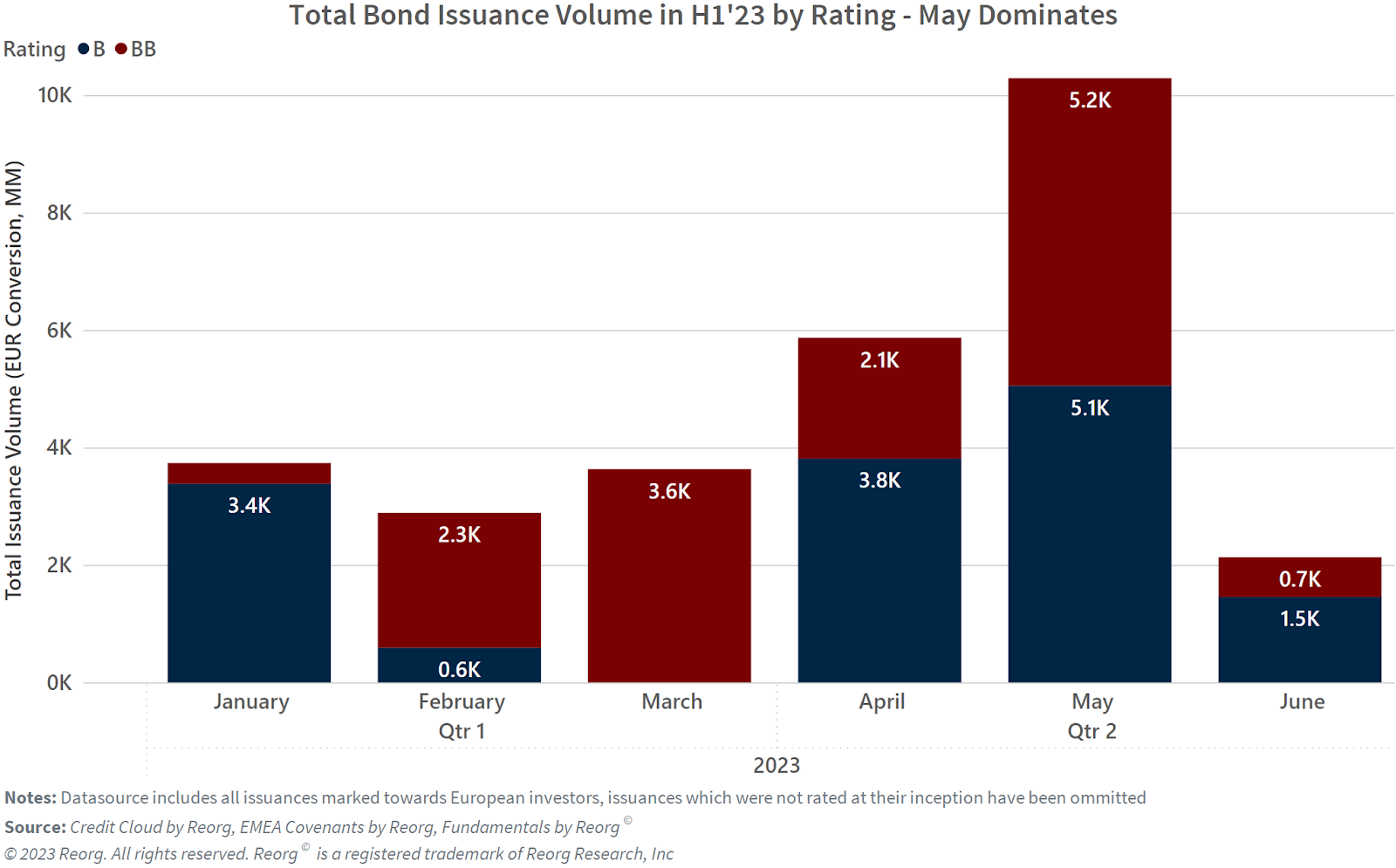

- Bond issuance in the European market more than doubled year over year to €55.8 billion in 2023, though this was half the €118.5 billion volume in 2021 and below the 10-year average. Term loan B issuance volumes rose three-fold to €87.75 billion in 2023.

- 2023 saw solid investor appetite, as 38% of bond issuances upsized in syndication and only 5% downsized.

- Teva Pharmaceuticals, Dana, Ams-Osram, Schaeffler, Worldpay, Solenis, Air France-KLM were among top performing bonds since launch in 2023. Isabel Marant, Amara Nzero, iQera, Cerved and Media and Games were among the worst performers.

- Refinancing drove 2023 high-yield issuances, as takeover activity was limited. Dividend recaps, which were absent in 2022, made a resurgence in 2023.

- Amend-and-extend dominated the loan market. In terms of use of proceeds, M&A activity in the loan market was more pronounced than in the bond market.

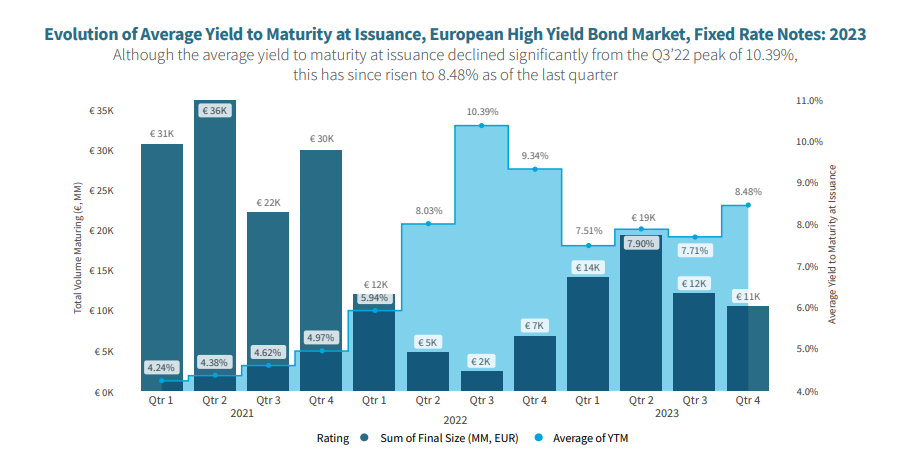

- The average implied yield to maturity, or YTM, at issuance for fixed rate bonds almost doubled to 8% in 2023 from 4.5% in 2021, but early 2024 issuances show signs of tightening.

- Average pro forma interest coverage ratio, or ICR, fell to its lowest level in five years to 4.1x, but is still reasonable.

- B rated bond issuances (fixed and floating) priced at an average implied YTM of 9%, representing a 208 bps spread on BB rated issuances, which priced at an average of 6.9%.

- The rating spread on TLB issuances was lower, at 100 bps, with a 476 bps margin above the reference rate on B rated issuances, compared with 376 bps for BB rated issuances.

- Lower credit quality issuers may have opted for loans rather than bonds as bonds demand higher rates and offer less flexibility. Similarly, margin on floating rate notes was slightly higher than the margin on equally rated floating rate loans.

- Significant work needs to be done to address the €76.5 billion of 2024 and 2025 bonds maturities.

- Takeover activity is expected to increase in 2024 as the gap in expectations between buyers and sellers reduces and private equity firms are under pressure to deliver returns. It will remain subdued compared with historical periods though.

- In the near term, repricings are expected to be a prominent feature of the loan market. CLO issuance is expected to provide support to the European loan market.

Unlock comprehensive insights by downloading the EMEA Primary Market wrap 2023 and delve into the complete report.

For more reports and guides by Reorg, please click here.

If you would like to be panelist on any upcoming webinars, please contact marketing@reorg.com, and if you would like to be notified for the upcoming webinars, sign up for Reorg on the Record.

To keep up on the latest coverage with Reorg, follow Reorg on LinkedIn and X.