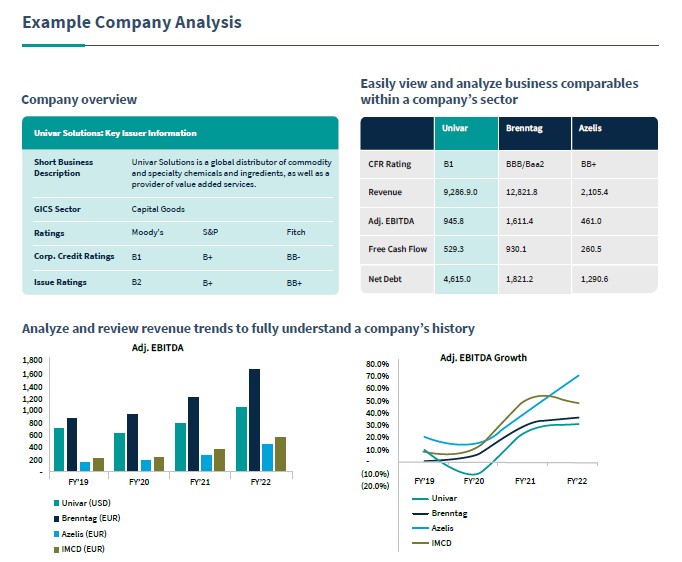

Introducing Private Company Analysis by Reorg

Reorg’s newest offering, Private Company Analysis, provides deep-dive insights into private companies across the full credit lifecycle.

Industry leading analysis, by the industry’s leading analysts

Developed by our expert team of buy- and sell-side professionals with decades of experience, this coverage includes deep dives, initiation coverage, models, tearsheets and more, ensuring you’re up to speed quickly and with all the information you need.*

Full credit lifecycle insights

In addition to covering all new issuances, Private Company Analysis offers key coverage across the full credit lifecycle, including:

- Comprehensive deep dives across primary names

- Readily access coverage of the 300 largest and most topical secondary situations for critical independent opinions

- Commentary and models for key post-reorg situations

To learn more about Private Company Analysis visit the webpage or contact sales@reorg.com

*In order to access a company’s Private Company Analysis, you must be confi’d on the deal