Reorg on the Record:Good news for investors, double-digit high yield is back…

If you’re not already receiving Reorg on the Record, sign up here: https://reorg.com/resources/reorg-on-the-record/

In these last few weeks of 2022 some European companies are taking advantage of a window in the primary market to issue debt to refi 2024, 2025 maturities or finance acquisitions. In the most telegraphed recession ever, management teams have the benefit of operating with some level of visibility and want to avoid surprises, hence dealing with maturities is key.

The good news for investors is that double-digit high yield is back, House of HR will likely raise its senior secured bonds at over 10% yield, Parques Reunidos is pricing its TLB3 at Euribor+525 bps with 96.5 OID. Funds across the pond seeking double-digit returns are becoming increasingly interested in EMEA senior secured paper in safe names like telecoms/cable.

Other issuers are being forced to look at alternative ways of dealing with maturities. Pronovias and Takko creditors have started negotiations again as 2023, 2024, and 2025 maturities loom. Food Delivery Brands, the old Telepizza, is also back negotiating with creditors.

In this last 2022 iteration of Reorg on the Record, looking back at the past 11 months in the distressed market, we have seen an increase in activity for legal and financial advisors pitching and getting mandates but overall still not many full-blown workouts as many companies dealt with their maturities in the past years leaving only a few stragglers out in the cold. In the loan market, covenant-lite docs combined with whitelists mean trading activity is frustrated with less pressure on management to act when companies underperform. With recession biting European economies, more opportunities for putting money to work and/or advising are expected in 2023 especially among small to medium-sized companies with less access to public capital markets.

Regards,

Mario Oliviero

Our European editorial teams are delivering the most in-depth data, analysis and reporting on thousands of credits that are either performing, stressed, distressed, going through restructuring or post-reorg. Check out these recent articles.

Hilding Anders

Hilding Anders was hit by a cyberattack in October that disrupted production and the Sweden-based mattress maker’s ability to ship and invoice orders. As a result, sales fell 18.2% year over year in the period while EBITDA halved. Liquidity remains tight but is set to rise according to the group’s 13-week cash flow forecast, however the group’s planned sale and leaseback of its Belgian site has been delayed, sources said. » Continue Reading

Intrum

Swedish credit management company Intrum issued €450 million senior notes due 2028 at a 10% yield to maturity, to partially redeem the existing €900 million 3.125% senior notes due 2024. Existing Intrum credit investors, who remain comfortable with the medium to long-term fundamentals of the business, could pick a 1% premium over the group’s existing notes maturing between 2025 and 2027 by buying into the new issue. Instead, prospective investors may look to the short end of the yield curve for a more attractive investment as the 86 bps premium of the 2028 notes above the 2025 notes may not be enough in compensating for the additional duration risk. » Continue Reading

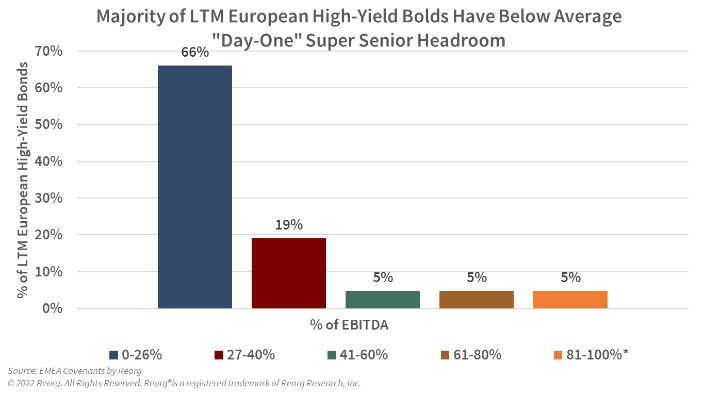

EMEA Covenants Monthly: November

The average super senior debt headroom under the credit facilities basket available to all high-yield bonds issued in the last twelve months is 26% of EBITDA. Our data-driven analysis shows that two-thirds of high-yield bonds issued in the last 12 months have below average headroom (26% of EBITDA) of additional super senior capacity. Just under a fifth (19%) had capacity between 27% and 40% of EBITDA while a small minority (15%) contained over 40% of additional super senior debt capacity. » Continue Reading

Pronovias

Law firm Kirkland & Ellis is advising Spanish wedding dress maker Pronovias in debt talks, sources told Reorg. Latham & Watkins is working with a group of creditors to Spanish wedding dress retailer Pronovias, which has an RCF maturing in March 2023, sources told Reorg. The BC Partners-owned company also has €215 million of first lien term loan maturing in 2024 and €80 million second lien due 2025. » Continue Reading

Webinar: On Nov. 17, Reorg hosted another episode of our deep dive webinar series, this time on the outlook for the distressed debt and restructuring market in Germany. With German corporates facing a winter of high gas prices, subdued consumer confidence and rising interest rates, the panel discussed what opportunities and challenges investors and restructuring professionals can expect. » Watch the replay

Podcast: Each episode of Reorg’s weekly EMEA Core Credit podcast series features detailed discussion on issues and companies across the credit lifecycle. This week’s podcast includes discussions of German real estate company Adler Group’s restructuring proposal, U.K. high street lender Metro Bank, Spandex producer Lycra’s refinancing talks; and highlights in the primary market this week. » Listen here