EMEA Primary Market Half-Yearly Wrap: Primary Market

Register for the Primary Market Insights Webinar on July 26 to hear about our findings in further detail here.

The European leveraged finance primary market recovered from its 2022 lows during the first half of this year. Term loan B amend-and-extend transactions, add-ons and refinancings formed the bulk of issuance and helped to push out maturities but resulted in higher interest costs and squeezed interest coverage ratios.

The second half of this year is expected to see similar activity, with high levels of primary issuance and large investor appetite for the high yields on offer, but M&As will remain suppressed. Interest rates remain stubbornly high and new supply will continue to be limited given private equity firms are unwilling to sell portfolio companies at valuations below their expectations.

We examine the bond and loan issuance trends from Jan. 1 through June 30, 2023, using data available on Reorg platforms.

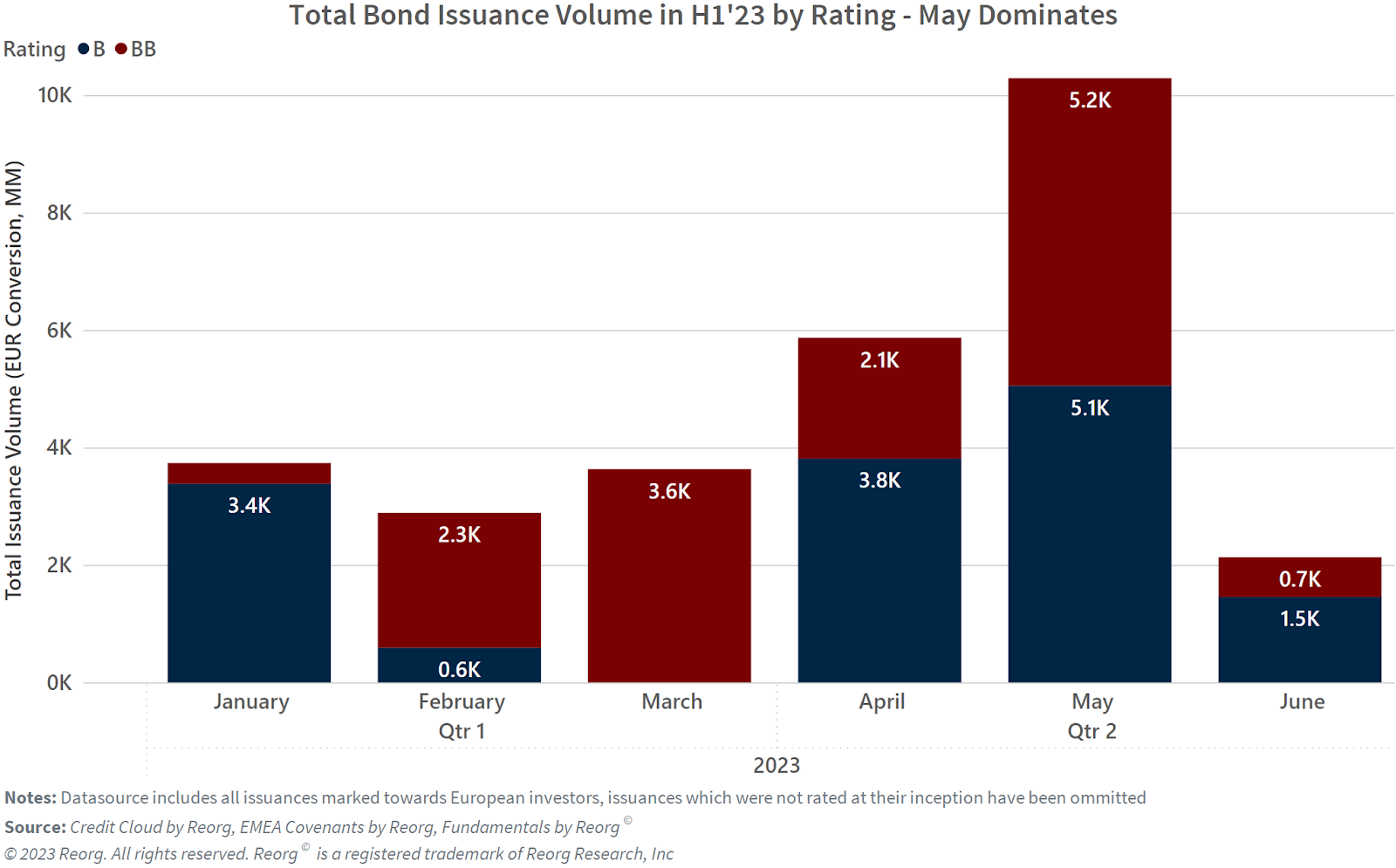

High-Yield Bond Issuance Doubles Amid Rate Hike Fears

Within Reorg’s coverage universe, a total volume of €33.3 billion has been issued in the European high-yield bond market in the first half – more than double the €15.5 billion volume of bonds issued in the same period last year. A major upswing in issuance came in May this year, during which €11.2 billion of paper was issued, double the volume of the prior two months combined. Issuance volume in the month was dominated by names at the highest and lowest end of the sub-investment grade rating range from BB+ to B-. The bulk of the issuance was within the first two weeks of the month, coinciding with an expectation of an increase in rates set by the European Central Bank and the Bank of England, which came on May 10 and May 11, respectively. With this in mind, we could expect to see a similar wave of conveniently timed issuances should inflation expectations remain elevated, prompting a need for further increases in rates set by the central banks.

Read the full article here.

Register for the Primary Market Insights Webinar on July 26 to hear about our findings in further detail here.

If you would like to be panelist on any upcoming webinars, please contact marketing@reorg.com, and if you would like to be notified for the upcoming webinars, sign up for Reorg on the Record.

To keep up on the latest coverage with Reorg, follow Reorg on LinkedIn and Twitter.