Understanding Reorg’s RCF Tracker

In today’s volatile business landscape, staying informed about the financial health of companies is crucial for making informed decisions, mitigating risks and identifying untapped opportunities in the credit market. One powerful tool that provides valuable insights into performing, stressed and distressed companies is Reorg’s RCF tracker. With its comprehensive coverage and regular updates, the RCF tracker equips professionals with the necessary information to navigate the complex world of revolving credit facilities (RCFs).

Understanding the RCF Tracker:

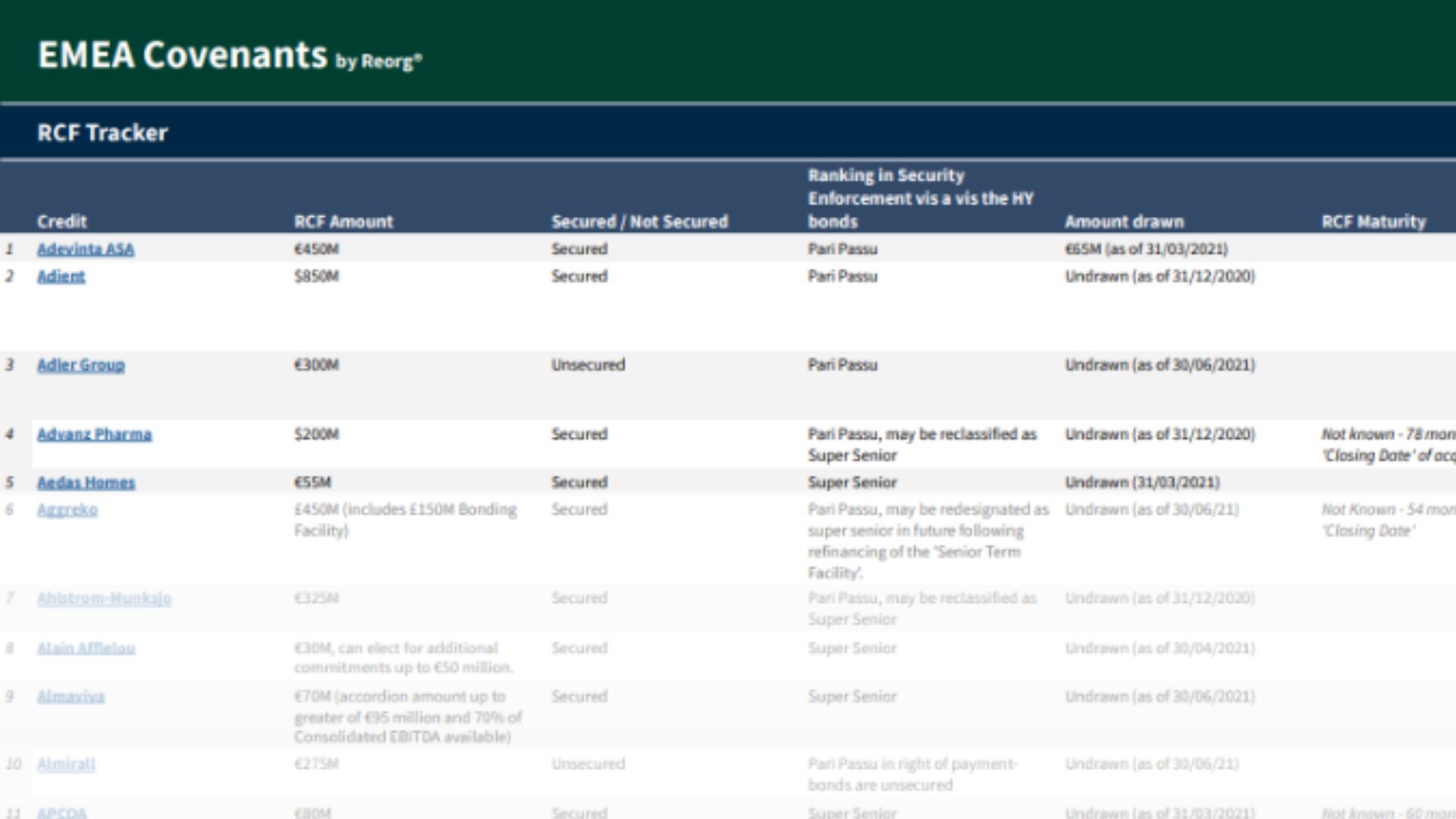

Reorg’s RCF tracker is an indispensable resource that monitors over 220 companies on a weekly basis, capturing the latest developments in their RCFs. It tracks a range of critical data points, including committed and drawn amounts of RCFs, financial covenants, covenant waivers, suspension periods, and the involvement of companies in debt negotiations or restructuring.

For investors and financial professionals, identifying distressed companies is of utmost importance. Reorg’s RCF tracker excels in this aspect by highlighting situations where companies could potentially breach their RCF covenants. This information serves as an early warning sign, enabling users to anticipate financial difficulties and make strategic decisions accordingly.

Recent Highlights from the RCF Tracker:

To showcase the effectiveness of Reorg’s RCF tracker, let’s delve into a few recent highlights and situations that were captured within the tool:

U.K. pub operator Stonegate Pub Company:

Stonegate Pub Company issued a warning that it could breach its RCF covenant at the July 2023 test date. This alert provides stakeholders with crucial insights into the company’s financial struggles, allowing them to assess the risks associated with Stonegate’s RCF.

U.K. and U.S. debt collector Encore Capital:

Encore Capital amended its existing global senior secured revolving credit facility agreement, extending the termination date from September 2026 to September 2027. The company also increased the facility size by $40 million to $1.18 billion. These updates, tracked by Reorg’s RCF tracker, shed light on Encore Capital’s efforts to optimize its credit facility, potentially indicating an improvement in its financial position.

Italy-based gaming operator Lottomatica:

Lottomatica signed a new €350 million RCF due in 2028, replacing the existing €297 million RCF due in 2024. This strategic move, captured by the RCF tracker, suggests Lottomatica’s proactive approach to refinancing its debt and maintaining a healthier credit profile.Conclusion:

Learn more about Reorg’s EMEA Covenants product, or contact us with any questions.