First Day Weekly: July Has Back-to-Back Weeks of Billion-Dollar Chapter 11 Filings

This week’s chapter 11 cases included a filing from asphalt construction company Premier Paving Ltd., extending 2022’s spike in industrials sector filings, stemming primarily from the construction subsector. The wave of cryptocurrency cases also continued this week, with a filing from Celsius Network, following filings earlier in July of the chapter 11 case of Voyager Digital and the chapter 15 of defunct cryptocurrency hedge fund Three Arrows Capital. Also this week, GenapSys, which has developed a “novel method” for DNA sequencing, filed to run a sale process after it stopped selling its DNA benchtop sequencer and offered refunds because of “inherent design flaws.”

Celsius Network, a cryptocurrency finance platform and lender that claims over 1.7 million users worldwide, filed chapter 11 to stabilize its business and consummate a “comprehensive restructuring transaction.” Without an RSA in hand, the company intends to fund postpetition operations using cash on hand, which “will provide ample liquidity to support certain operations during the restructuring process.” The company explained in a press release that it paused customer account withdrawals on June 12 because “without a pause, the acceleration of withdrawals would have allowed certain customers – those who were first to act – to be paid in full while leaving others behind to wait for Celsius to harvest value from illiquid or longer-term asset deployment activities before they receive a recovery.”

The company says its stabilization and restructuring pursuits would allow Celsius to “emerge from chapter 11 positioned for success in the cryptocurrency industry.” Celsius adds that as a result of the company’s asset-preservation strategies, it holds approximately $4.3 billion in assets and $780 million in “non-user liabilities” as of the petition date.

The debtors say that after “early success,” the “amount of digital assets on the Company’s platform grew faster than the Company was prepared to deploy,” causing the company to make “what, in hindsight, proved to be certain poor asset deployment decisions,” some of which the debtors say “took time to unwind” and “left the Company with disproportional liabilities when measured against the unprecedented market declines.” Despite the company’s efforts to unwind these asset deployments, “unfortunately, the damage was done,” the debtors say. In addition, the debtors face “other unanticipated losses,” including a private lender’s inability to return the company’s collateral when Celsius attempted to repay a loan in July 2021. According to the declaration, this resulted in the company holding an uncollateralized claim against its lender in the amount of about $509 million after setting off its own loan obligations.

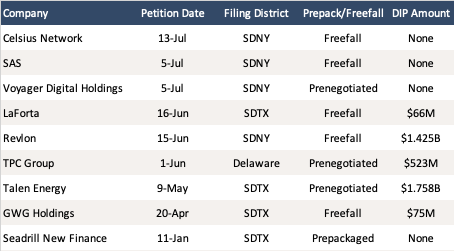

Celsius is the year’s ninth chapter 11 involving more than $1 billion in liabilities and the month of July’s third. Out of the year’s nine, six have filed in the last 45 days: