2022 European Restructuring Wrap

The wave of hard financial restructurings expected in Europe in 2022 to rival the 2008/9 crisis appears to have been mistimed. As a result of cheap debt and fiscal support available since the Covid-19 pandemic, stressed debtors have been able to avoid insolvency or restructuring.

In our 2022 European Restructuring Wrap, legal experts analyze the restructurings from 2022 and look ahead to 2023. Here’s a few key takeaways from 2022:

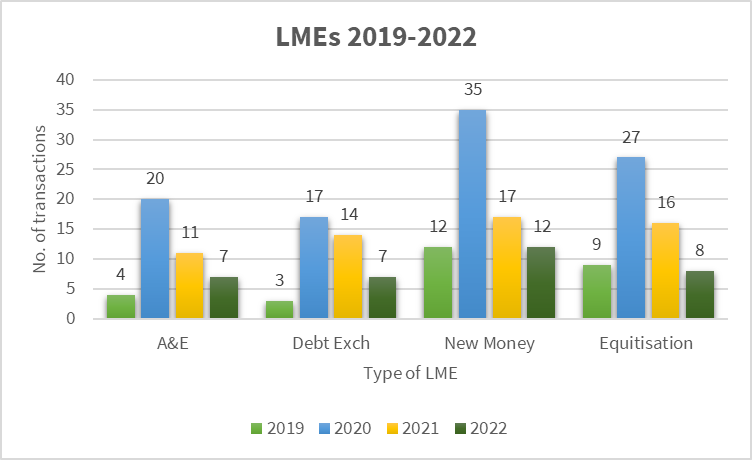

- Restructuring activity, defined by the occurrence of liability management exercises (LMEs), in 2022 has briefly returned to pre-pandemic levels, following a surge in 2020;

- During 2022, a higher proportion of restructuring transactions (63%) were implemented consensually compared with the previous two years;

- Restructuring transactions that introduced new money at a secured, senior secured or super senior secured level in 2022 were more likely (66%) than non new money deals to have been implemented using a restructuring tool, (non consensually);

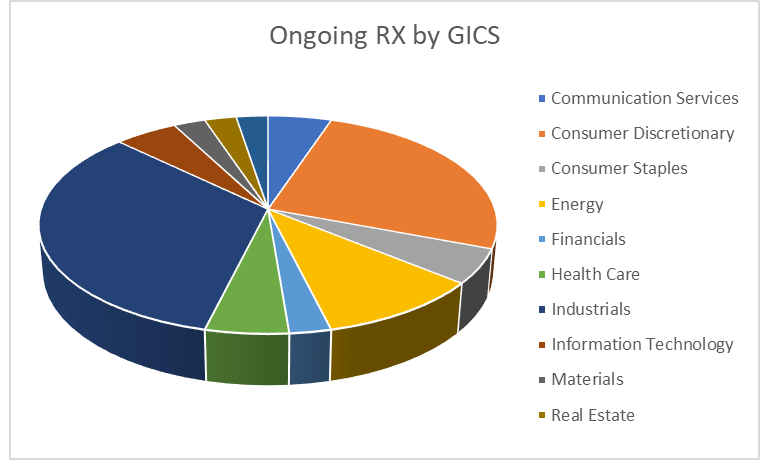

- There has been a large uptick in restructuring advisor appointments over the last three months. Reorg is currently monitoring 45 debtors who have appointed advisors but not yet completed a restructuring. Consumer discretionary, energy and industrial sectors feature most prevalently in this list and further details on each name can be found on our EMEA Special Situations Tracker.

Examining our observations, and wary of the previously mistimed predictions of increased restructuring activity, we have the following outlook for 2023:

- Following a busy Q4’22, we expect to see a continued increase in restructuring activity in Europe throughout 2023.

- We also expect to see a high percentage of consensual LME exercises over the coming months. We could see the occurrence of LME exercises match the higher levels seen in 2020 and 2021 – marking an increase from 2022;

- English law tools (being the scheme of arrangement and restructuring plan) will continue to feature heavily in non-consensual European restructurings, in spite of the recent proliferation of new domestic restructuring tool in other European countries;

- We expect to continue to see amend and extend, or A&E, activity in the short term, with a lot of borrowers facing maturity issues in the coming years. A&Es offer an opportunity for lenders to reprice and avoid hard restructurings which could cause credit investors to prematurely realize losses

Data compiled by Reorg in our EMEA Restructuring Database, available exclusively through Credit Cloud, paints a fascinating picture, hinting at what we might see in the financial restructuring arena in 2023.

Read the full article written by Reorg’s Shan Qureshi or catch up on other recent intelligence articles published by Reorg.

For full access to Reorg’s platform of news, analysis and data built for financial and legal professionals, request a trial.