EU Taxonomy Disclosure Challenges for Asset Managers

Check out Reorg’s latest whitepaper to dive deeper into the EU Taxonomy.

What is the EU Taxonomy?

In response to escalating environmental challenges, the European Union (EU) has devised a tool to steer investments toward sustainable endeavors: the EU Taxonomy.

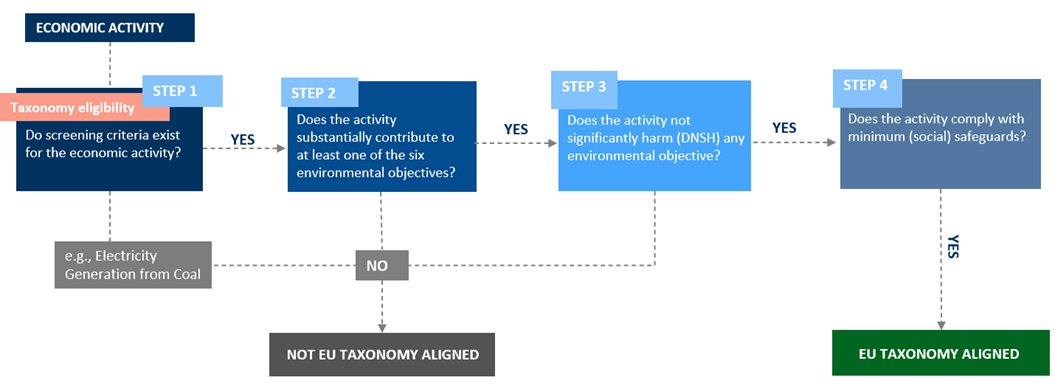

The EU Taxonomy serves as a classification system that helps define economic activities that are environmentally sustainable through four overarching conditions, outlined in Article 3: contribute to at least one of the six environmental objectives, do not significantly harm any of the environmental objectives (DNSH), comply with minimum safeguards, and with technical screening criteria.

How is an economic activity taxonomy aligned?

In 2023, the largest non-financial corporations reported on how well they adhered to the Taxonomy’s initial environmental goals, focusing on climate mitigation and adaptation. In addition, financial institutions disclosed the degree to which their assets met the criteria for alignment with the Taxonomy.

How companies are reporting or how should they report?

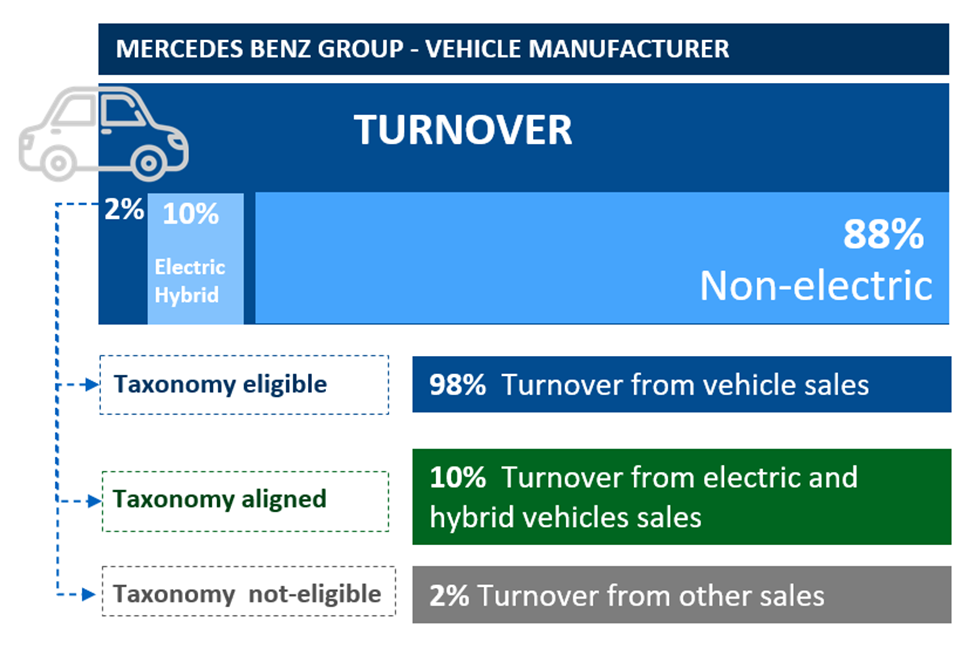

Non-financial companies are required to report on the proportion of their turnover, capital expenditure (CAPEX), and operating expenditure (OPEX) related to products, services, or processes associated with economic activities that qualify as environmentally sustainable.

For example, a vehicle manufacturer falls within the scope of the EU Taxonomy being considered eligible. However, only the manufacture of low-carbon technologies for transport that contribute to climate mitigation would be taxonomy-aligned (1). This means that only electric vehicles, and hybrid vehicles, if they meet the specific emissions criteria, are aligned with the Taxonomy’s sustainable criteria.

In the case of Mercedes Benz Group, the company stated in its 2022 Sustainability Report that 88% of its turnover was taxonomy-eligible and 10% was taxonomy-aligned, as seen below, succeeding in making a substantial contribution to the Climate Change mitigation objective, passing the Do No Significant Harm (DNSH) criteria and comply with minimum safeguards. When it comes to capital expenditures, the company reported that 78% was taxonomy-eligible and 22% was aligned. While operating expenditures are 65% eligible and 35% aligned.

In 2021, estimates and early testing of the climate taxonomy criteria have shown a low overall Taxonomy alignment today in companies’ activities and investment portfolios (between 1% and 5%, with many companies and investment portfolios standing at zero) (2).

In 2024, companies are still struggling to navigate the complexity of the regulation. Most private companies do not report on taxonomy-eligible activities as some may not fall under the regulatory requirements or may need more resources to conduct the necessary assessments. As the Corporate Sustainability Reporting Directive is being rolled out, we anticipate an increase in companies reporting taxonomy-related data.

Why should Asset Managers report?

For asset managers, the EU Taxonomy is important for several reasons:

- The Taxonomy provides a standardized way to identify and categorize environmentally sustainable activities, helping asset managers communicate with clarity about the sustainability of their investments.

- It enhances transparency by offering a clear set of criteria for what qualifies as environmentally sustainable.

- Asset managers can use the EU Taxonomy to assess and mitigate environmental risks in their portfolios.

- Following the EU Taxonomy can enhance the credibility of asset managers in the market.

- The Taxonomy is a deterrent against greenwashing, where companies overstate their environmental credentials

What is the difficulty for Asset Managers?

Asset managers must disclose taxonomy-related information both at the product and entity levels. This includes details on the alignment of financial products with the Taxonomy and the proportion of investments aligned with sustainable economic activities.

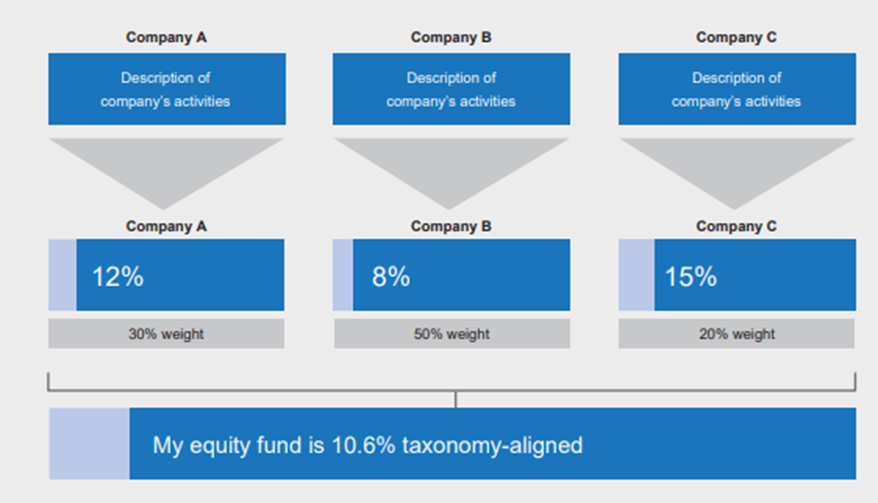

To report on Taxonomy alignment at the product level, asset managers are required to go through all the underlying assets within a fund’s portfolio to determine if they contribute to any of the six environmental objectives. Given the diversified nature of funds, such a calculation requires extensive data collection from investee companies along with substantial allocation of time and human capital resources.

How does it work in practice?

The disclosure of taxonomy-aligned activities at the company level feeds up into disclosures of taxonomy-aligned activities at the portfolio level. The graph below provides a simplified explanation of how to apply the Taxonomy, considering turnover as the proxy for equity exposure to Taxonomy-aligned activities.

Source: Technical Report, EU Technical Expert Group on Sustainable Finance, 2020

ESGx by Reorg has worked with the private markets to solve disparate data collection and reporting for SFDR, TCFD, and exercises across other regulatory and investor reporting requests since inception in 2021. As the EU Taxonomy reporting comes live, ESGx by Reorg is well-positioned to integrate and collect the KPIs for the reporting exercise, as the data becomes available.

Unlock comprehensive insights by downloading the EU Taxonomy Whitepaper now and delve into the complete report.

For more reports and guides by Reorg, please click here.

To learn more about ESGx by Reorg, please click here.

- Manufacture of low carbon technologies for transport, EU Taxonomy Navigator

- FAQ: What is the EU Taxonomy and how will it work in practice?, 2021