Access robust financial information: Analyzing Revlon’s chapter 11 timeline

Breaking down the intricacies of complex or long-term situations over time can be an elaborate or daunting task. But Reorg’s robust and well-organized financial analyses can easily help you and your team get up to speed on even the most rapidly developing situations.

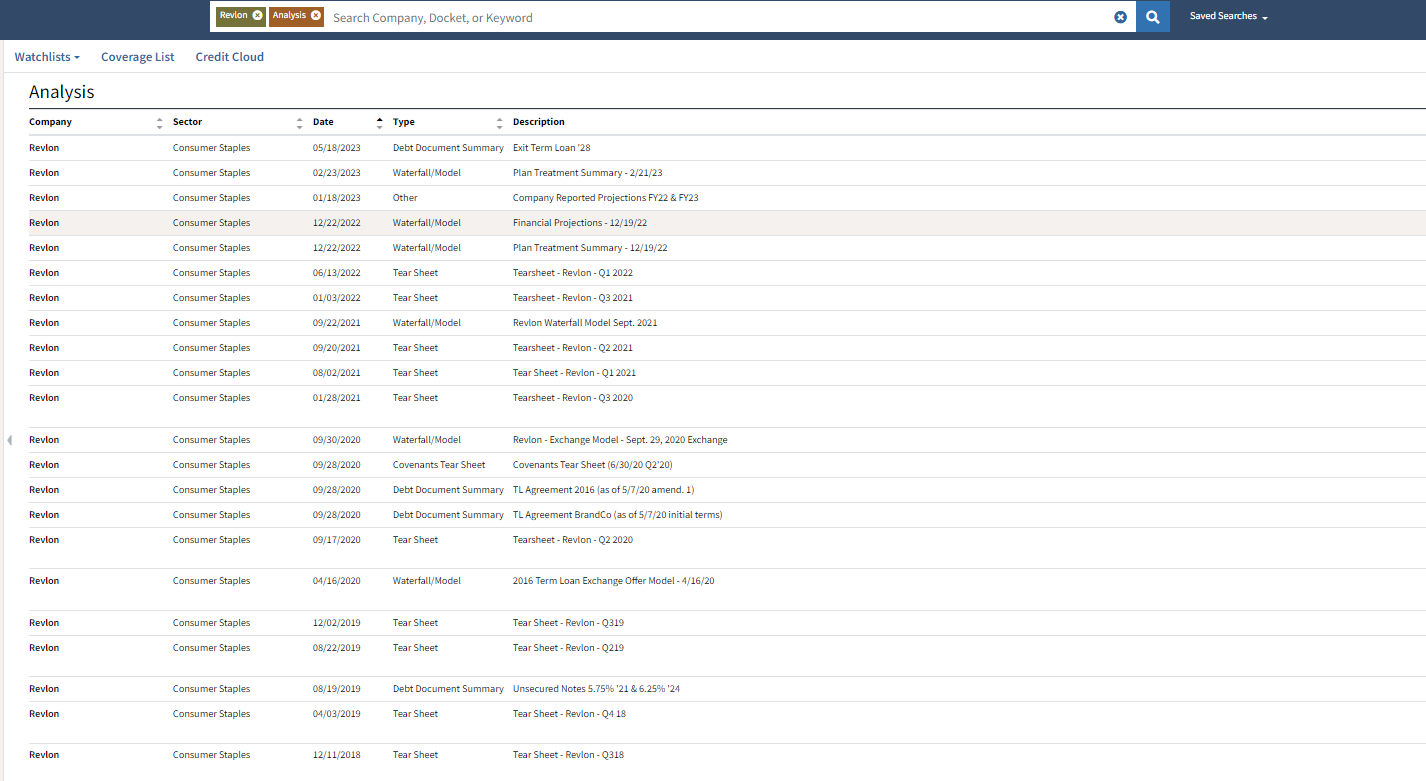

For example, our coverage of Revlon’s restructuring over the past several years includes regularly updated financial tear sheets, covenants tear sheets, exchange models, waterfall models, Excel uploads of management projections and plan treatment models, including (but not limited to) the following:

- In 2020 Reorg published exchange models after the BrandCo transaction;

- In 2021 Reorg published a waterfall model illustrating BrandCo and RemainCo lenders’ recoveries;

- Earlier this year, Reorg published a plan treatment model illustrating treatment and proposed recoveries for BrandCo and RemainCo lenders, rights offering participants and backstop parties; and

- Finally, just after Revlon emerged from chapter 11 this month, Reorg developed and published an analysis of Revlon’s exit term loan.

If you’d like to explore all of the Revlon coverage in between, or learn more about the financial analysis we have available on the next topical restructuring you work on, request a trial